Aside from giving you quick access to cash when you need it most, Brigit also helps you get your finances on track. It allows you to monitor your spending habits, avoid overdrafts, and send real-time alerts so you wouldn’t miss any payments. With Brigit, you can loan up to $250, which should be enough to cover emergencies. If you need more, you can use the following apps like Brigit to help you get by until your next paycheck.

Apps like Brigit

- Dave

- MoneyLion

- Ingo Money

- Chime

- Even

- Branch

- Earnin

- Affirm

- DailyPay

- Activehours

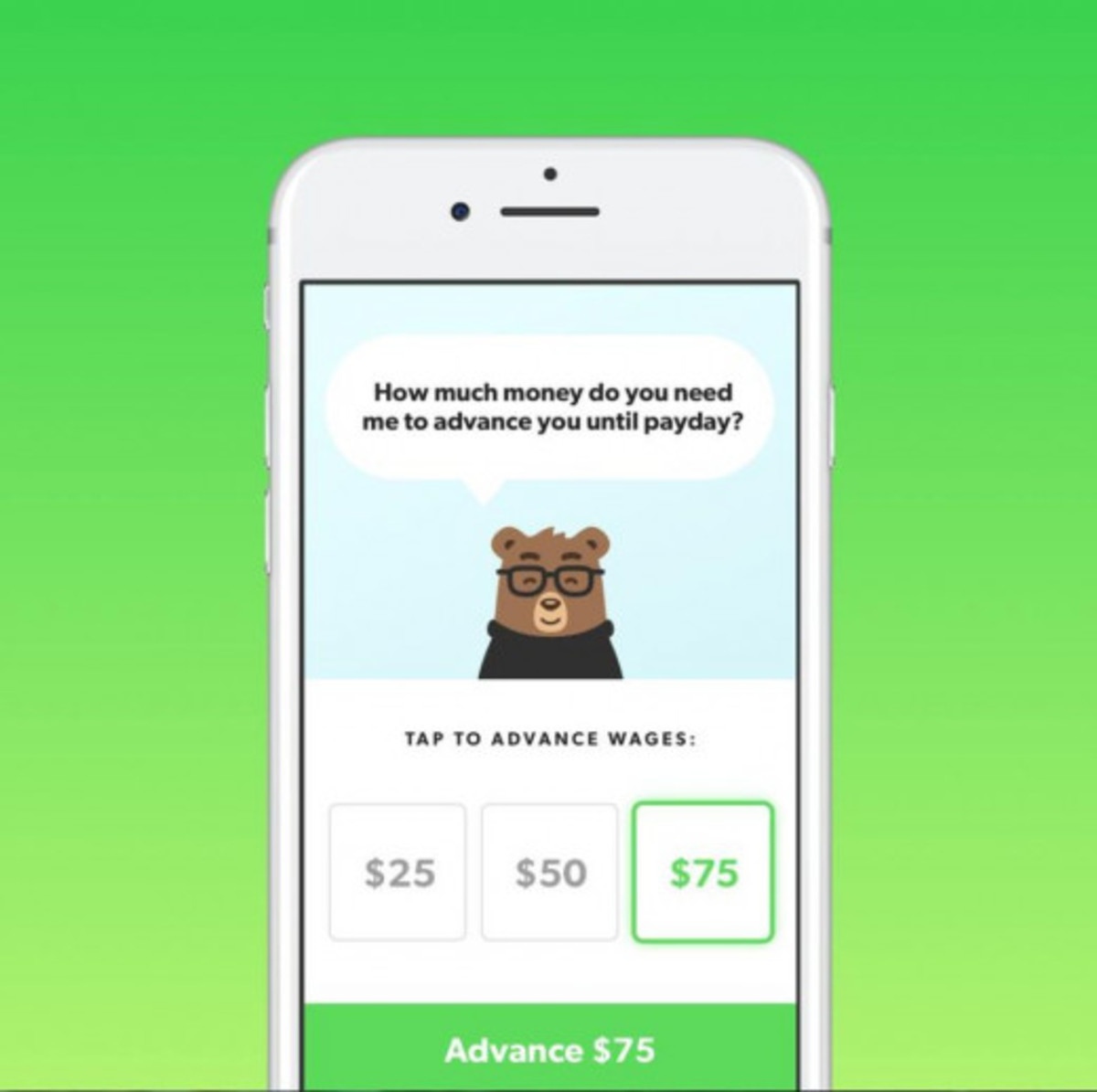

1. Dave

When talking about cash advance apps, no list is complete without mentioning Dave. It boasts of an enormous user base, which doesn’t come as a surprise considering the ease with which users can borrow money. Dave has a ton of features like Brigit, but it offers a lower payday advance. The limit is pegged at $100. While this is a smaller number, it can prove useful in helping you borrow just the right amount of money to pay for emergencies. The monthly fee of $1 hasn’t deterred countless repeat customers from using the app.

2. MoneyLion

MoneyLion lives true to its name by providing a robust set of features for users looking for a simple way to get payday advances. Just like Brigit, this app lets you borrow $250 per day. The only caveat is that you must register using a checking account. One of the best things about MoneyLion is that it transfers your loan amount straight to your bank account on the same day. Take note, however, that the amount you borrow cannot exceed 10% of your direct deposit.

3. Ingo Money

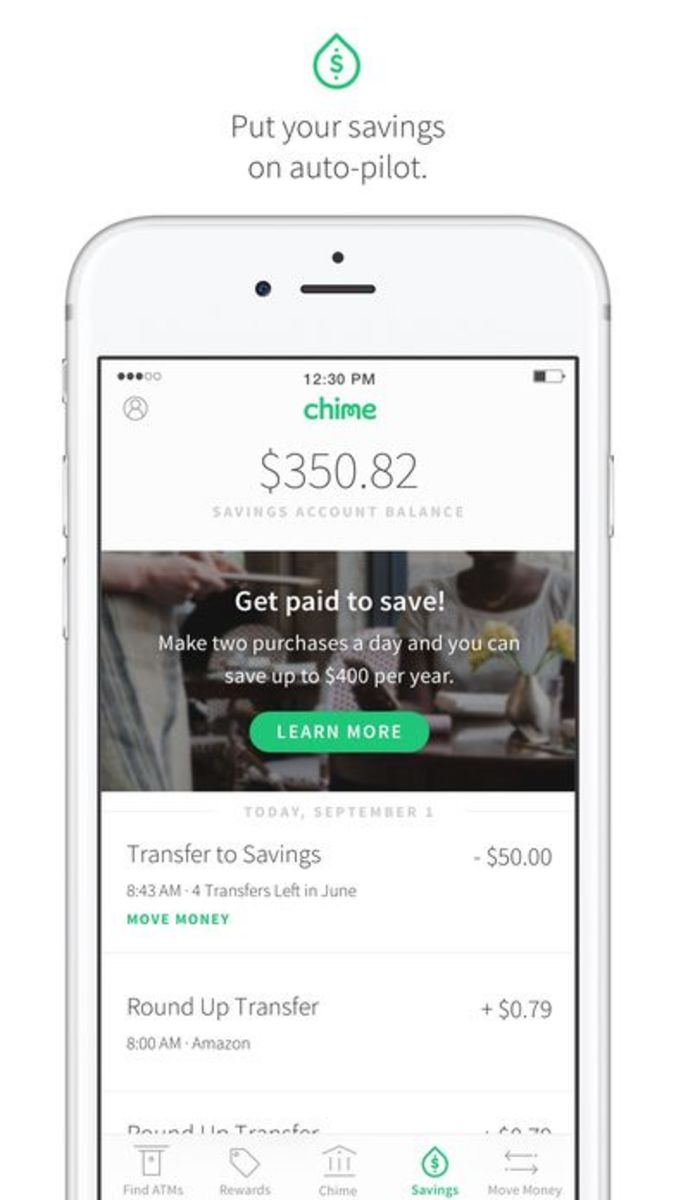

4. Chime

Chime works a little differently compared to the other apps on this list. The reason is that it functions more like a mobile banking app, enabling you to avoid overdrafts, set up automatic savings, and make secure online transactions. But many people also use it for getting paid early. With Chime, you can get your paycheck up to 2 days in advance without any hidden fees. Combine this with the other features and it’s easy to see why it has become an award-winning app.

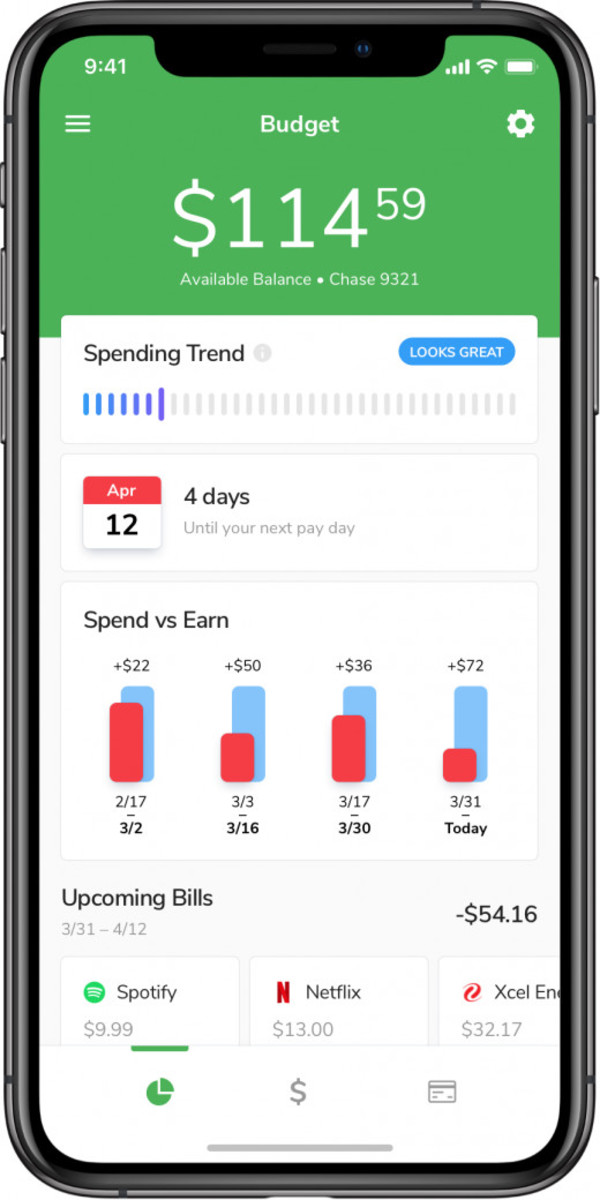

5. Even

Even ranks as one of the best financial planning apps. It offers cash advances equivalent to 50% of the money you’ve earned as long as you’re working for a qualified employer. It proves to be an excellent Brigit alternative because it offers plenty of the same features, such as helping you allocate funds for specific expenses and sending alerts to avoid penalty and overdraft fees. To become an Even Plus member, you need to pay a monthly fee of $8.

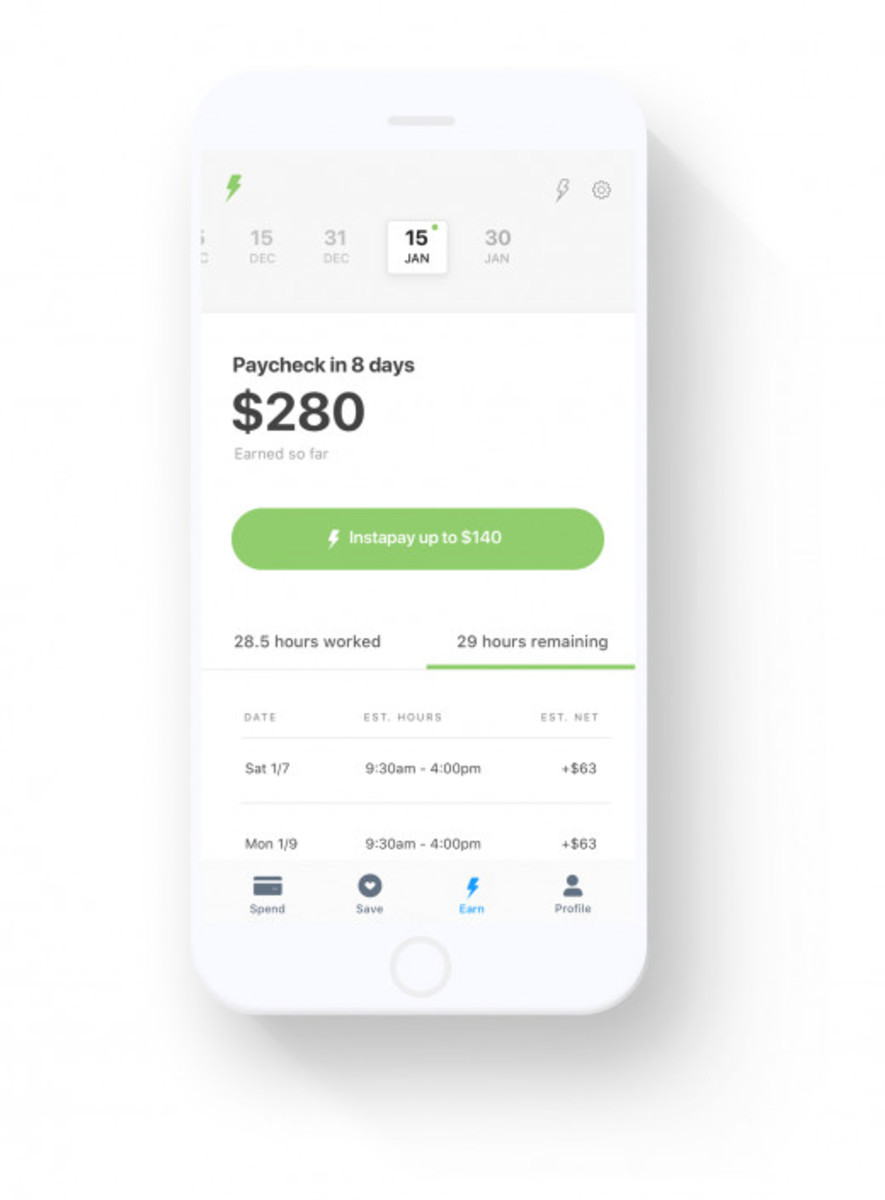

6. Branch

If you’re looking for an app that works like Brigit, then Branch is definitely a must-try. It’s a cash advance app that also comes with social features such as the ability to communicate with co-workers, change your work schedule, and log your daily work hours. You can borrow $150 per day or $500 per pay period. Just remember that your employer must also use Branch. Additionally, each cash advance only applies to a specified period. This means you need to upload a new set of working hours for each application.

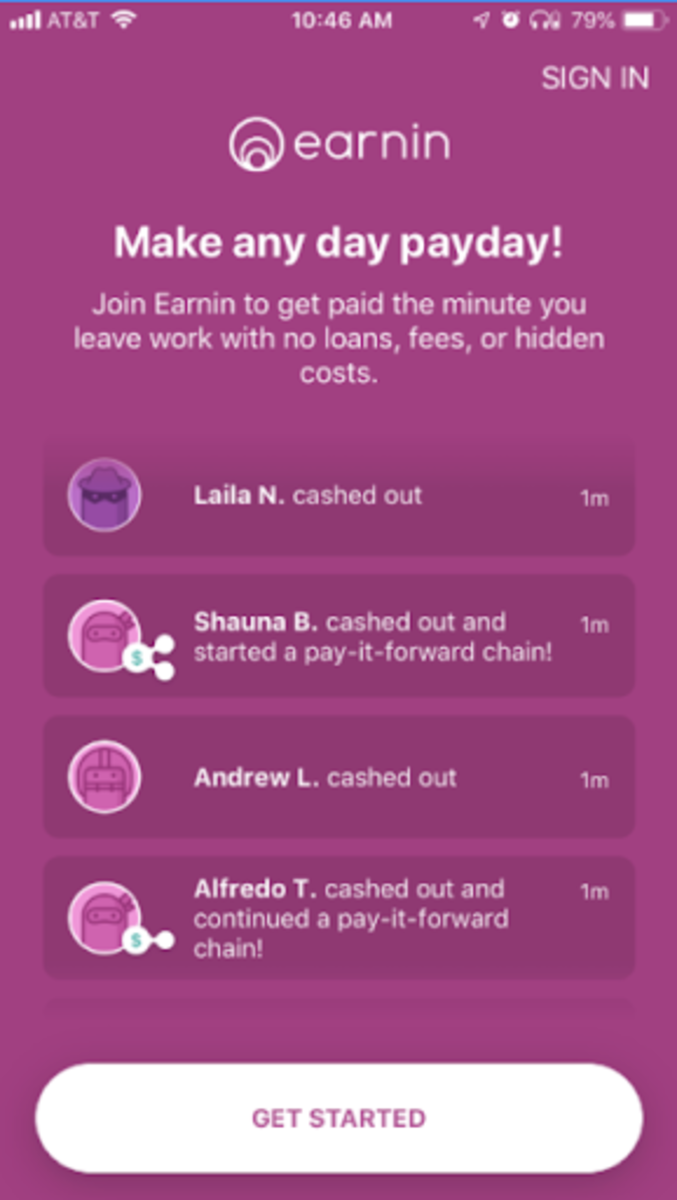

7. Earnin

Earnin has all of the features you’d expect from an app that loans you money but without any monthly fees. Thousands of employees turn to Earnin to get a cash advance. If you accumulate a ton of work hours, you may even qualify for a loan amount of up to $500 per day. That’s a sizeable amount, which should be enough to pay for costly emergencies. And with its Lightning Speed program, your loan amount is transferred to your bank account on the same business day.

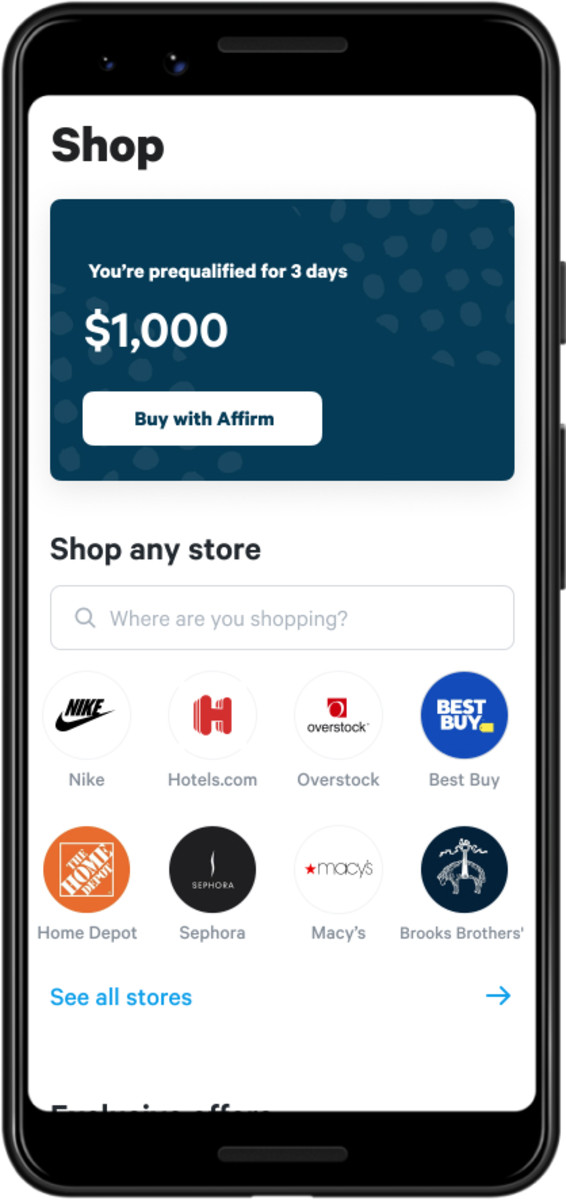

8. Affirm

Affirm is quite unique in terms of how the app works. Instead of merely serving as a cash advance app, it offers a suite of features that make it easy to control your expenses, allocate funds for each, and make secure payments by turning the app into your virtual credit card. While it’s not an app that lets you borrow money in the traditional sense, it can still prove useful if you do a lot of online shopping. Affirm also enables you to send money to other users in a matter of seconds.

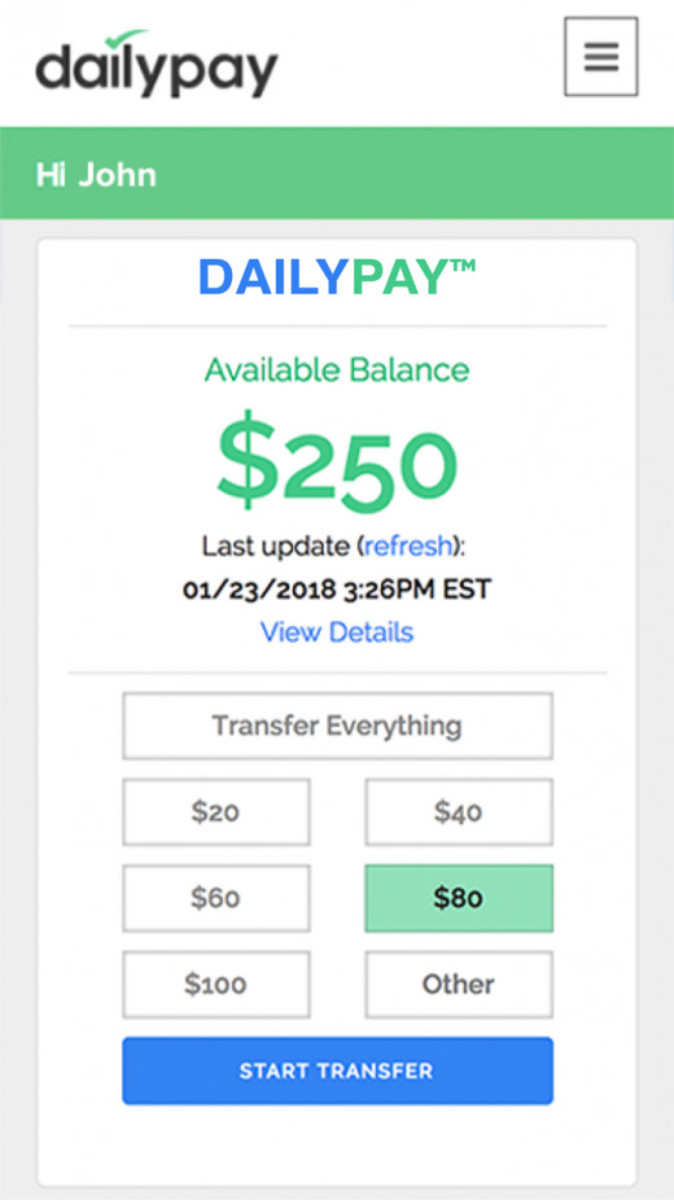

9. DailyPay

On the surface, DailyPay looks like an app geared toward employers rather than employees. But it shares many similarities with Brigit. As an employee, your balance builds up as you accumulate work hours. And once you find yourself in a financial crunch, you can tap into your balance and get access to your payday earnings instantly. One your payday arrives, the amount your borrowed will be taken from your paycheck. Transferring money from your DailyPay balance to your bank account costs a measly $1.25.

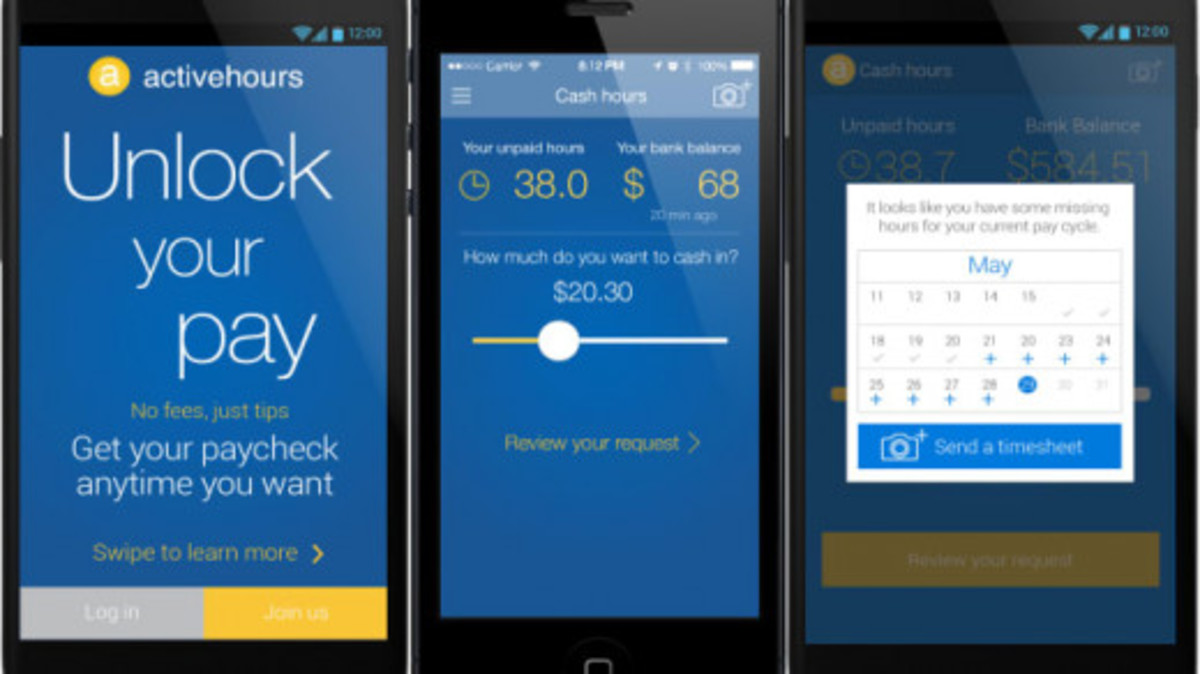

10. Activehours

Activehours is another app that employees can use to access their earnings before payday. As long as your employer also uses Activehours, you can rely on the app as a source of funds during emergency situations. What’s great about this app is that you can withdraw up to $100 per day, making it a popular choice among people who work a lot of hours each day. It also has a feature where you can monitor all of your expenses, which proves useful in teaching you how to better control your finances.

Are These Brigit Alternatives Worth It?

Getting a loan is easier now more than ever. You don’t have to worry about credit checks, interest rates, and long queues at the bank. These apps that loan you money come with minimal requirements and often send you money on the same day. But just because they offer quick access to cash doesn’t mean you should abuse them. Remember that these loan apps are intended to help you during a financial crisis. Use them responsibly and educate yourself about the proper ways to spend money, build up savings, and cut back on unnecessary expenses.